franklin county ohio sales tax rate 2020

The sales tax jurisdiction. Average Sales Tax With Local.

Property Tax Abatements How Do They Work

1 lower than the maximum sales tax in OH.

. STATE OF OHIO. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax. The current total local sales tax rate in Franklin OH is 7000.

The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax rate. The tax rate was increased to 4 effective September 1. There is no applicable city tax or.

2020 rates included for use while preparing your income tax deduction. The sales tax rate for Franklin County was updated for the 2020 tax year this is the current sales tax rate we are using in the Franklin. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the.

The Ohio state sales tax rate is currently. 1149 rows 2022 List of Ohio Local Sales Tax Rates. There is no applicable city tax.

PAGE 1 REVISED October 1 2020. The Franklin County sales tax rate is. 2020 rates included for use while preparing your income tax deduction.

The following list of Ohio post offices shows the total county. The City of Rossford in Wood County assesses transit rate of 050 in addition to the posted state and county sales tax rate. COLUMBUS OH 43216-0530.

The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. DEPARTMENT OF TAXATION. Ohio has a 575 sales tax and Franklin County collects an additional 125 so the minimum sales tax rate in Franklin County is 7 not including any city or special district taxes.

Lowest sales tax 6 Highest sales tax 8 Ohio Sales Tax. The latest sales tax rate for Franklin Furnace OH. The latest sales tax rate for Franklin County OH.

The sales tax rate for Franklin County was updated for the 2020 tax year this is the. If you need access to a database of all Ohio local sales tax. PAGE 1 REVISED October 1 2020.

What is Ohio sales tax rate 2020. By emailing the Franklin County Treasurers Office you may obtain an email listing of properties included in the tax lien certificate sale. Such public record requests may be directed to.

State and Permissive Sales Tax Rates by County April 2022. Sales tax in Franklin County Ohio is currently 75. Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the. This rate includes any state county city and local sales taxes. Click any locality for.

This rate includes any state county city and local sales taxes. The December 2020 total local sales tax rate was also 7000. The 2018 United States Supreme Court decision in South Dakota v.

Ohio has state sales tax. 2020 rates included for use while preparing your income tax deduction.

Ohio Taxes Apps On Google Play

Ohio Sales Tax Guide For Businesses

Ohio Sales Tax Calculator Reverse Sales Dremployee

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Ohio Sales Tax Rates By City County 2022

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara

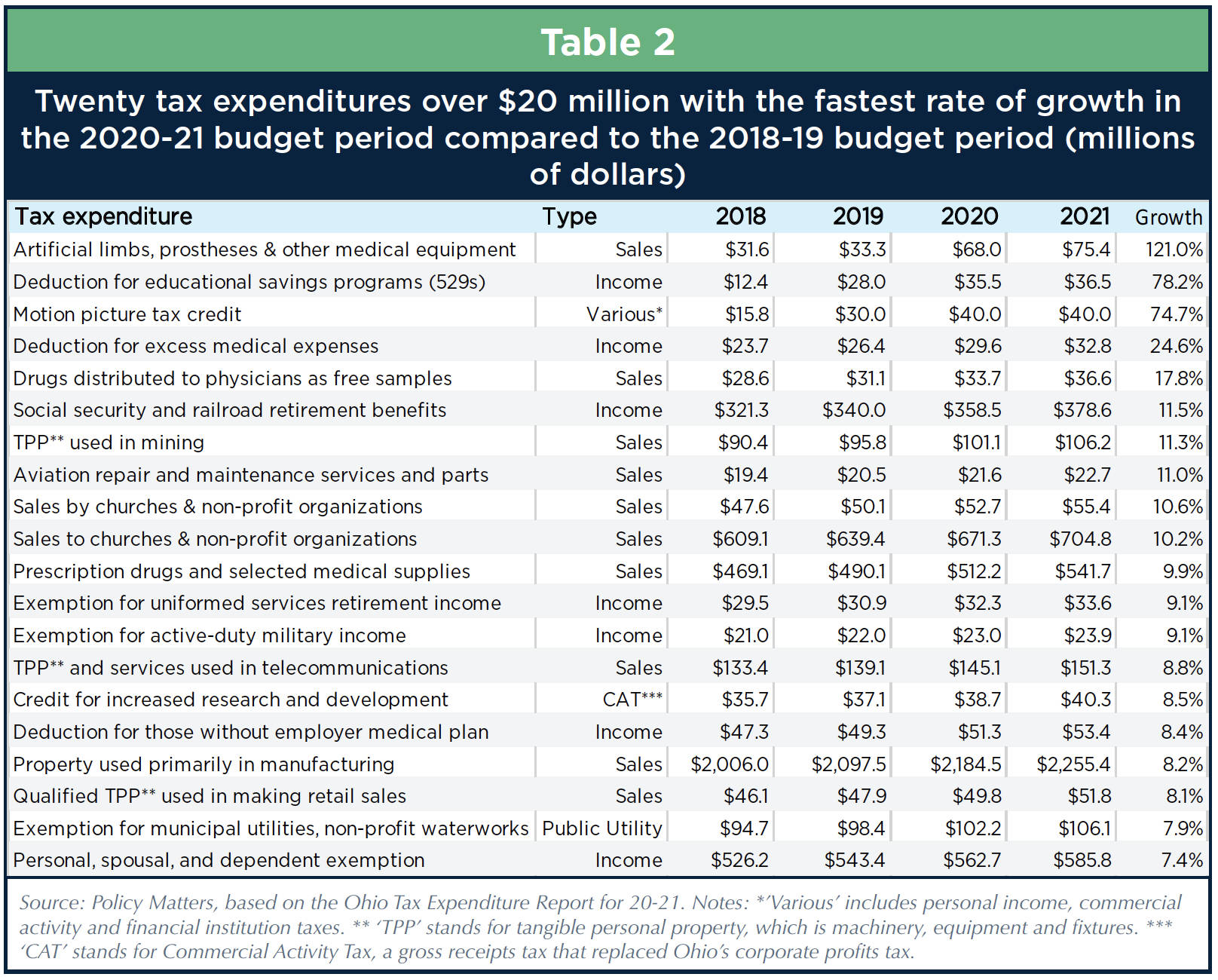

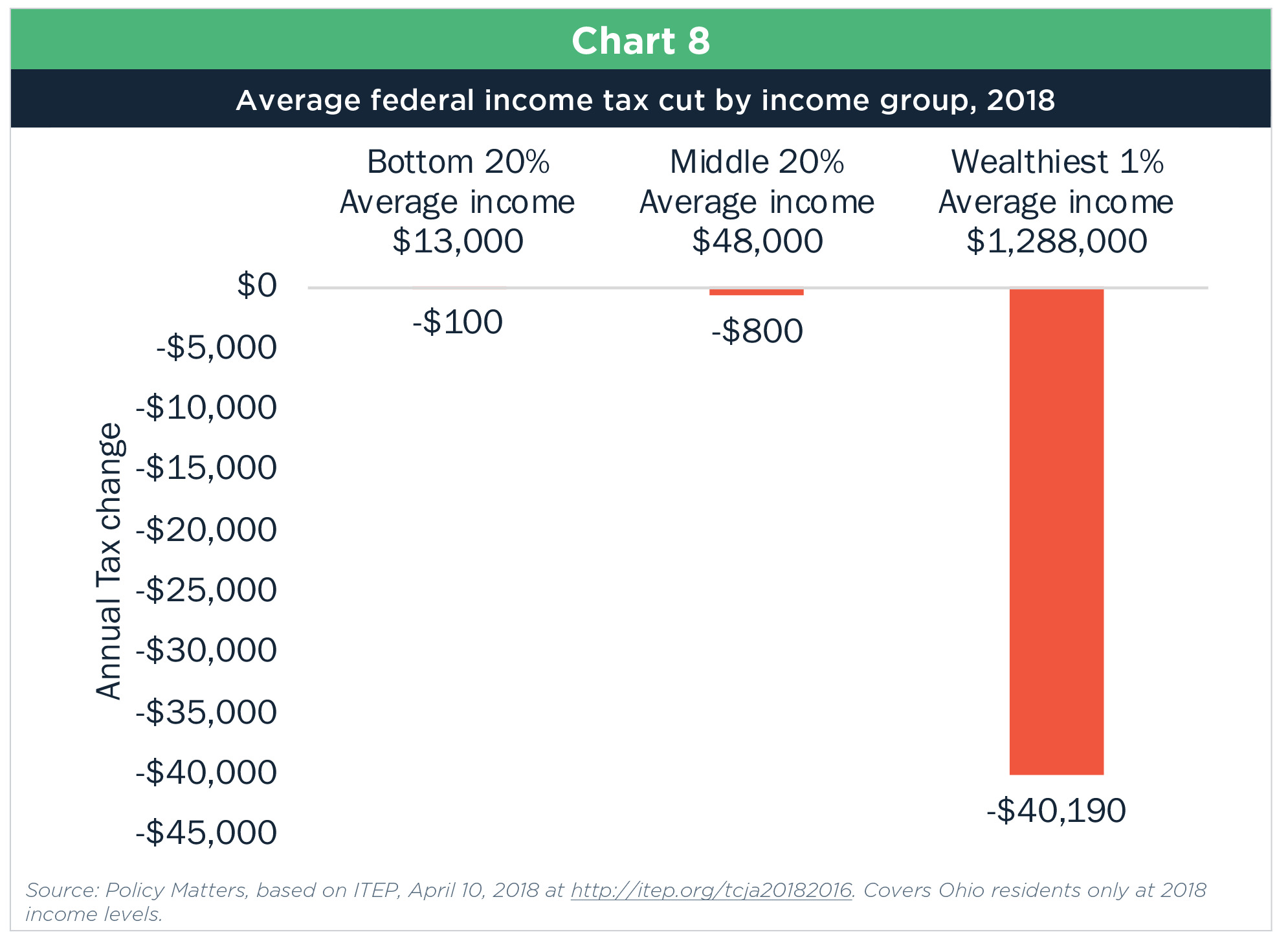

Overhaul A Plan To Rebalance Ohio S Income Tax

Income Tax Repeal A Bad Deal For Ohio

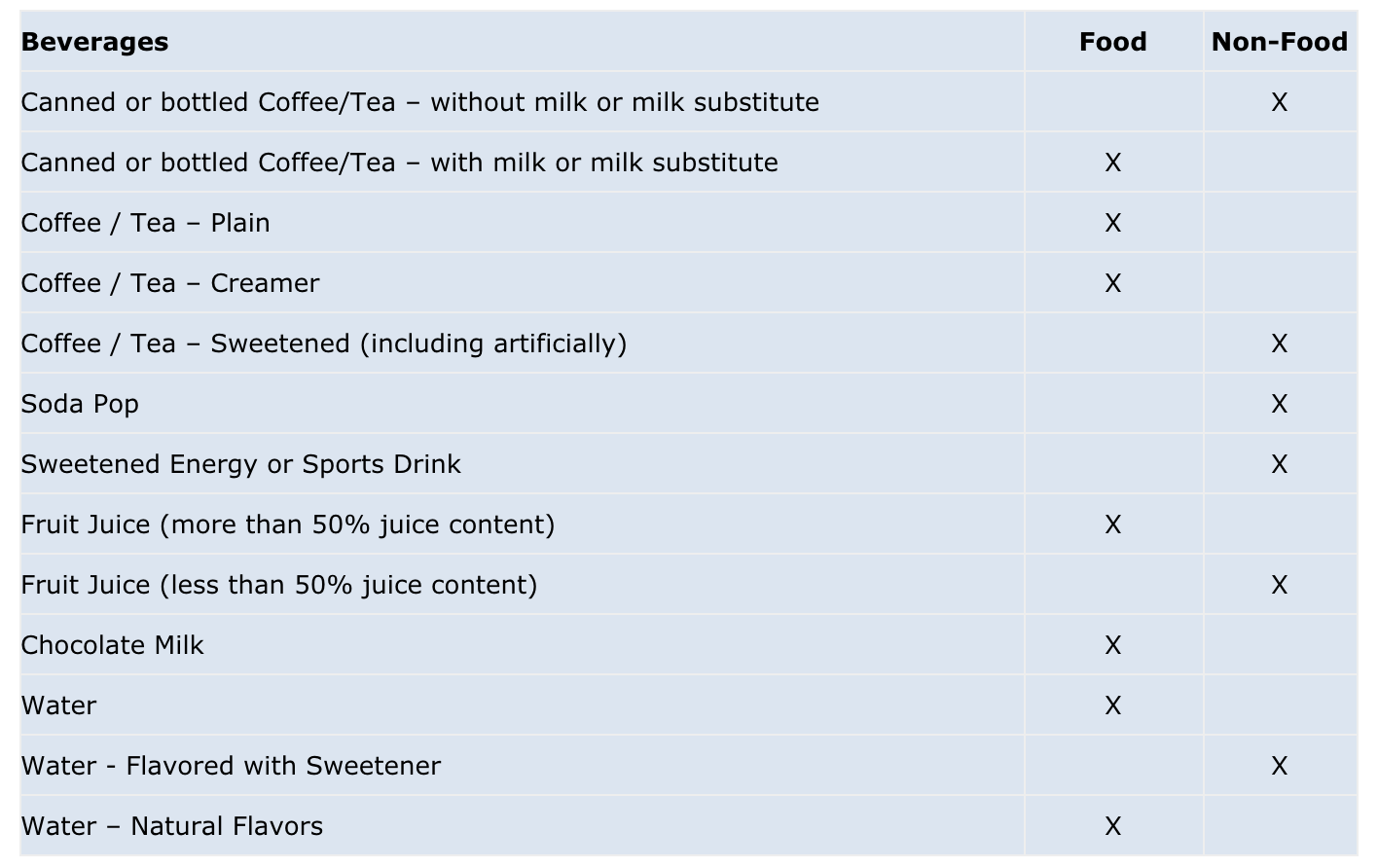

Is Food Taxable In Ohio Taxjar

Ohio Sales Tax Rates How Does Your County Compare

Ohio Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Local Income Taxes In 2019 Local Income Tax City County Level