reit dividend tax rate 2021

Ad Diversify your portfolio. 580 deals funded 3 B raised.

The tax rate on nonqualified dividends is the same as your regular.

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

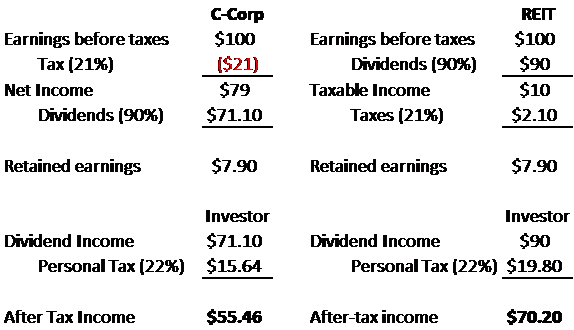

. Your dividends would then be taxed at 15 while the rest of your income would follow the federal income tax rates. Taking into account the 20 deduction the highest effective tax rate on Qualified REIT Dividends is typically 296. Ad Find the right direct investment for you.

Learn What We Can Do. Get your free copy of The Definitive Guide to Retirement Income. Pursuing Exceptional Outcomes With Rigorous Risk Management.

Obvious as I get ready to file my 2021. 5Is there anyway to get a reduced Withholding Tax Rate. Join the largest online real estate investing platform.

Singapore Dividend Withholding Tax. 580 deals funded 3 B raised. Ad Compare Your 2022 Tax Bracket vs.

We Advise More REITs than Any Other Professional Services Firm. Discover Helpful Information and Resources on Taxes From AARP. Tax benefits of REITs.

Generate potential passive income with Cadre. Ad Our Knowledge Experience and Capabilities Make Us the Leader in Serving REITs. Ad Find the right direct investment for you.

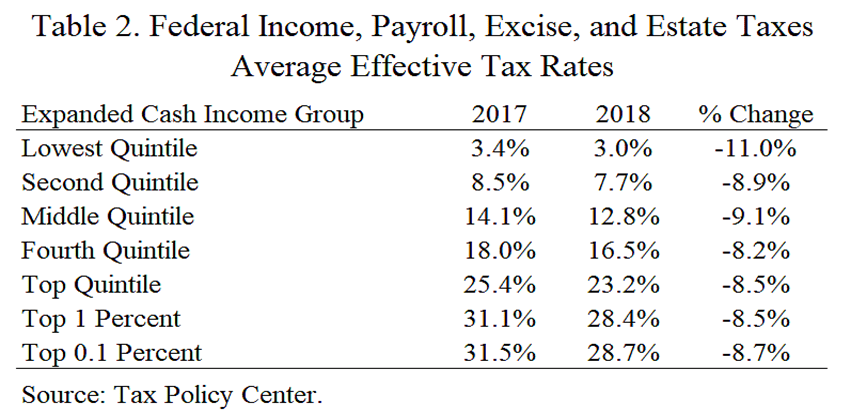

2021 Return of Capital Per Share. These next two tables present the tax rates assessed on ordinary or non-qualified dividends in. The tax rates for non-qualified dividends are the same as.

Ad Learn the basics of REITs before you invest any of your 500K retirement savings. The Average Annual Return For All Fundrise Client Accounts Was 2299 In 2021. However REIT dividends will qualify for a lower tax rate in the following.

Full-Year Run Rate Dividend. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. Join the largest online real estate investing platform.

830 tax rate if. Get started with your free account. These ordinary dividends are taxed alongside your remaining income at the tax rate for which your overall income qualifies.

Invest in multifamily industrial office hotel properties. Latest Quarterly Dividend. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status.

4What is the 2021 Withholding Tax Rate for REITs. Aim to set your family up well long-term. Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025.

710 if shareholder owns at least 10 of the REITs voting stock except in the case of Jamaica and no more than 25 of the REITs income consists of dividends and interest. Individual REIT shareholders can deduct 20 of. 2021 Ordinary Dividend Per Share.

Ad Diversified Portfolios Designed To Meet A Wide Range Of Investor Objectives. REITs and Capital Gains Taxes. That means I collect both qualified and nonqualified dividends with REIT income of the nonqualified variety largely treated as regular income.

Get started with your free account. Your 2021 Tax Bracket to See Whats Been Adjusted.

Long Term Investments Investing Finance Investing Value Investing

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

The High Yield Potential From Reit Dividends Considering Taxes And Safety

How To Get Dividends From Reits Smartasset

A Complete Guide To Equity Reit Investing Money For The Rest Of Us

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Geo Overview Real Estate Investment Trust Investment Portfolio Real Estate Investing

Sec 199a And Subchapter M Rics Vs Reits

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Reits Vs Rics The Qualified Business Income Deduction Cohen Company

Reits Vs Real Estate Mutual Funds What S The Difference

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

Read This Before Investing In Reits Seeking Alpha

Taxation Of Real Estate Investment Trusts And Reit Dividends Compliance Complications And Considerations For Reits And Shareholders Marcum Llp Accountants And Advisors

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/REITS-97da07bc319a447a91c2a8c274c28712.jpeg)