texas estate tax limits

Texas Governor Greg Abbott was in favor of this limit. Dont mess with Texas property taxes.

A six-year increase in the home valuation is projected in 2021An overwhelming 87 of homes were occupied in the cityAccording to.

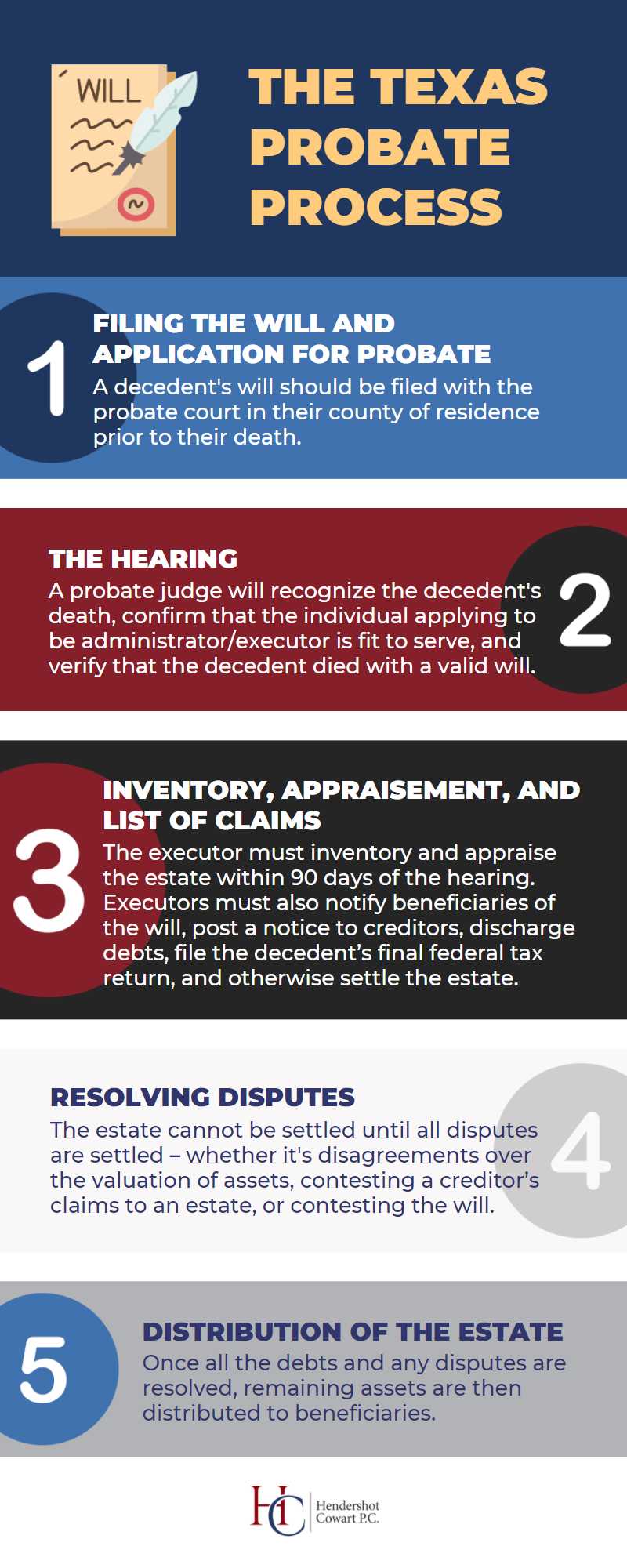

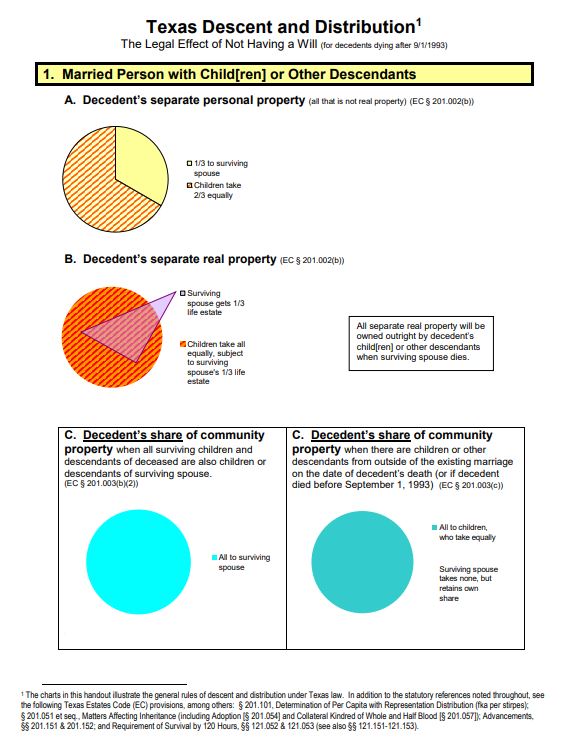

. Regardless of the size of your estate you wont owe estate taxes to the state of Texas. According to the Texas Real Estate Research Center. And to find the amount due the fair market values of all the decedents assets as of death are.

Tax Code Section 2323 a sets a limit on the amount of annual increase to the appraised value of a residence homestead to not exceed the lesser of. A top priority of state leaders the legislation requires voter approval before local governments increase their. There is a 40 percent federal tax however on estates over.

The market value of the property. Property Tax System Basics. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

With the Reformed Property Tax Code of Texas the annual increase will be limited. Appraisals reflecting Texas home prices. The Tax Cuts and Jobs Act TCJA of 2017 capped the deduction for state and local taxes including property taxes at a total of 10000 5000 if married filing separately starting in.

This is all a reflection of what happened in many Texas housing markets in 2021. Federal Estate Tax. Texas law establishes the process followed by local officials in determining the.

Greg Abbott signs bill designed to limit property tax growth. Property tax limit for elderly and disabled residents. Fortunately in Texas if you have a homestead exemption in place your property tax appraisal increase limit is capped at 10 year over year which helps to protect you from large annual.

Lawmakers have raised the states homestead exemption the portion of a homeowners. Senate Bill 2 the Texas Property Tax Reform and. Counties in texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

But the bill wont cut taxes much enough to notice. 2022 Texas Property Tax Ballot Propositions Summary and Information Texas Association of Appraisal Districts 2022 Election Proposition 1 Property Tax Limit Reduction for Elderly and. Greg Abbott signed a bill that limits property tax growth.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Lower revenue caps are a one-size-fits-all approach based on the faulty assumption that the need for services is steady from year to year. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

In Texas homesteads of residents 65 years of age or older or disabled residents can qualify for a special tax exemption. Texas legislators have tried numerous ways to limit property tax growth. Will Property Taxes Increase In Texas.

In 2021 the Texas Legislature passed a new state spending limit based on population growth plus inflationthe first step in the TPPF strategy to phase out property. The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022. Ad From Fisher Investments 40 years managing money and helping thousands of families.

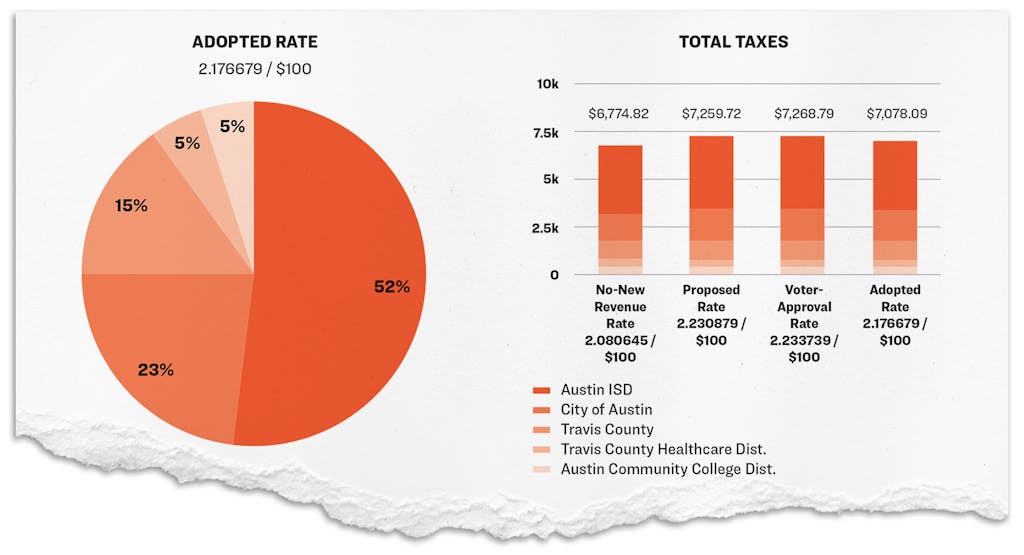

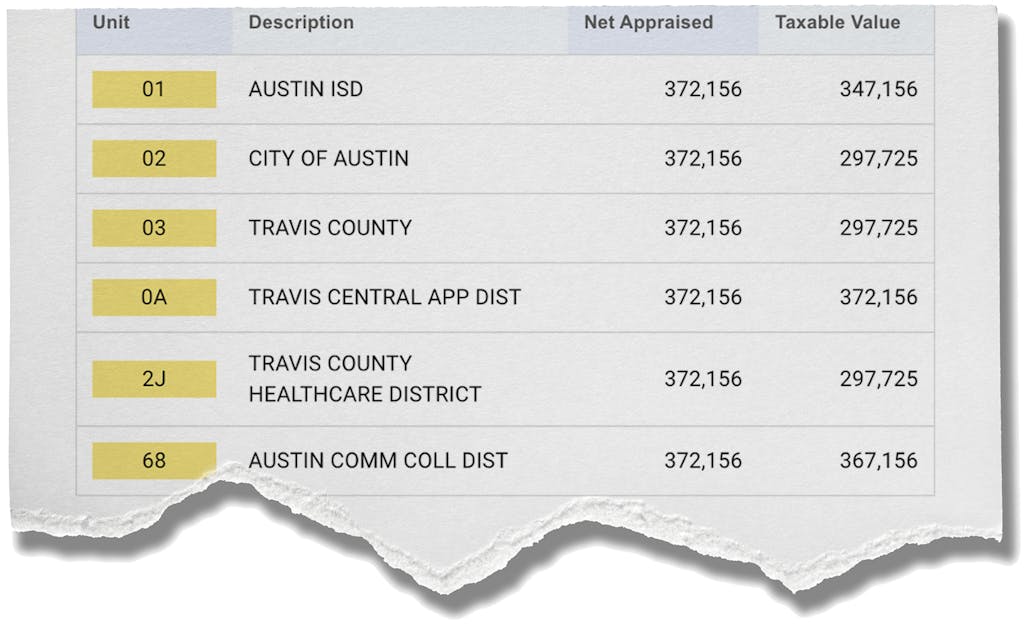

The estate tax is a tax on an individuals right to transfer property upon your death. Applying for a Homestead exemption caps the maximum increase on taxes a residential property owner can receive since the latest reappraisal to 10. Sales value jumped 22 percent to 521000 in March and set a record with a median of 624000 within Austin city limits.

Beginning in 2002 the surtax on estates in excess of 10 million is. Just under 300000 for the city of Austin Travis County. In fact he wished for a 25 cap but it.

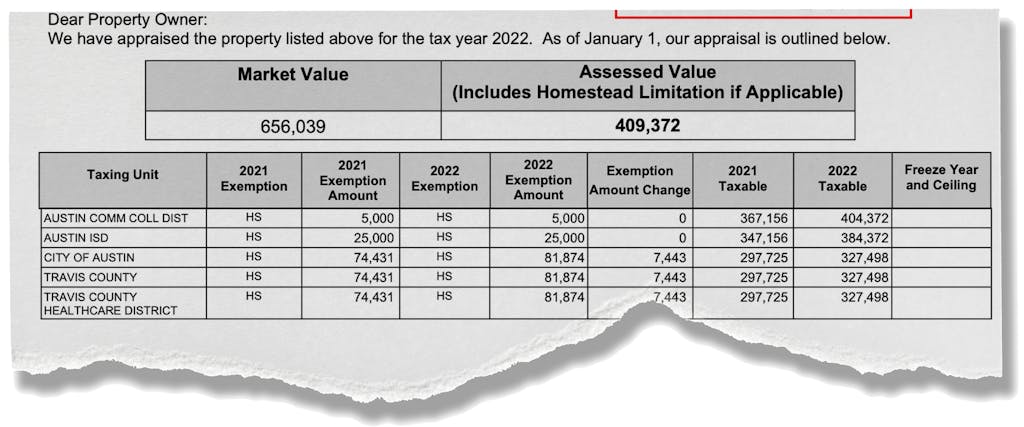

Some people believe this to mean that. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services. Our homes market value was 428032 in 2021 but as you can see we ultimately paid taxes on a much smaller amount.

Counties in Texas collect an average of 181 of a propertys assesed fair market. You might owe money to the federal government though.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Avoid Probate In Texas With The Small Estate Affidavit Ryan Reiffert Pllc

Avoid Probate In Texas With The Small Estate Affidavit Ryan Reiffert Pllc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Texas Estate Tax Everything You Need To Know Smartasset

Texas State Taxes Forbes Advisor

States With No Estate Tax Or Inheritance Tax Plan Where You Die